10th September, 2016, Cuttack: One is puzzled by the accounting treatment for Justice Indrajit Mahanty’s Rs 2.5 crore working-capital loan for his hotel, The Triple C. Lakhs of rupees are withdrawn and repaid every month in two SBI loan accounts in the name of “Justice Indrajit Mahanty” and strangely, not in the name of Latest Generation Entertainment Pvt. Ltd., the company that has leased the hotel from him. As a High Court judge, Justice I. Mahanty gets a monthly salary of Rs. 1.35 lakhs, and therefore is liable to pay Income Tax. But repayment of principal plus interest could reduce or eliminate his taxable income. Suppose his tax returns are dodgy, can Income Tax authorities summon his lordship personally for questioning u/s 131 of Income Tax Act, and compel production of his lordship’s books of account?

We asked Mr Binoy Gupta, a retired Chief Commissioner of Income Tax (CCA), who holds a Ph.D. in Law. His reply was: “There are no exemptions in any law for any Supreme Court or High Court Judges from any judicial or quasi judicial proceedings. Our department has taken action under the Income Tax Act against them.”

We requested Mr Gupta for case studies (with or without the names of the judges) to substantiate his claim of having taken action against judges. His response was: “I can not give any instances today. But I stand by my statement that Judges of the Supreme Court and High Courts have no special status so far the applicability of Income Tax Laws are concerned.”

And then Mr Gupta added that bringing a judge to justice is a tough job. He wrote: “If any govt. servant engages himself in business, his department can and does take action. But the procedure for taking action against Judges is far too complex… impeachment which is extremely difficult.”

Given the absence of case studies and other details of judges being held accountable by Income Tax authorities, our gut feeling is: IT authorities will never dare to summon his lordship, because (a) they would be in awe of a high court judge, and (b) because the high court has superior jurisdiction over the Income Tax department, and not vice versa. Even if judges do not enjoy de jure immunity from quasi-judicial and administrative authorities, they enjoy de facto immunity. No government official will risk rubbing a high court judge the wrong way by questioning him, even if the law permits him to do so!

In return for such unquestioned authority and immunity, judges are expected to keep their affairs transparent and straightforward, by abstaining from business activities. Their income should ideally consist of their salaries, and interest on fixed deposits etc. — nothing more complicated than that. To quote YK Sabharwal, former Chief Justice of India, who spoke on the Judicial Canon of Ethics, “Almost every public servant is governed by certain basic Code of Conduct which includes expectation that he shall maintain absolute integrity… manage his financial affairs in such a manner that he is always free from indebtedness, and not involve himself in transactions relating to property with persons having official dealings with him.” Please note that seeking building permissions, bank loans, hotel licenses, etc. etc. are all transactions with the government, administration and public sector, who all have “official dealings” with a high court judge in his judge-like capacity. Such transactions adulterate the purity of Justice Indrajit Mahanty’s judgment.

According to the Restatement of Values of Judicial Life (adopted by Full Bench of Supreme Court on7th May, 1997), “A Judge should not engage directly or indirectly in trade or business, either by himself or in association with any other person.

And according to the Bangalore Principles of Judicial Conduct, 2002, “A judge shall not only be free from inappropriate connections with, and influence by, the executive and legislative branches of government, but must also appear to a reasonable observer to be free therefrom.”

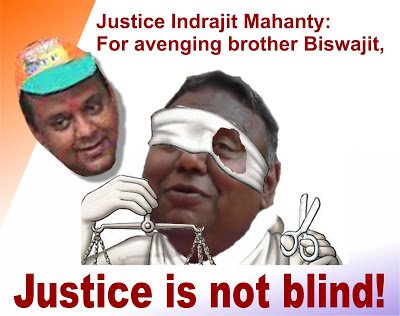

Read all these documents on judicial ethics and in that context, understand the significance of Justice I Mahanty’s actions. Justice Indrajit Mahanty may or may not have broken any laws, but he is definitely in breach of ethics on multiple counts.

So, must we all remain silent like Gandhiji’s three monkeys? Must we all adopt a policy of See-no-evil, hear-no-evil, speak-no-evil when it comes to judges? Must the adulteration of our judicial services be allowed to continue under cover of a conspiracy of silence?

ISSUED IN PUBLIC INTEREST BY

Krishnaraj Rao

9821588114

krish.kkphoto@gmail.com

Posted By Sulaiman Bhimani 9323642081 sulaimanbhimani11@gmail.com

Earlier articles on this topic:

1) Judge-cum-Hotelier Indrajit Mahanty of Orissa HC: Is his conduct ethical?

2) What if Justice Indrajit Mahanty defaults on his “Debt Burden”?

3) Mysteries in Justice Indrajit Mahanty’s proxy-press-release

Related topic: Will somebody please impeach Manipur Chief Justice LK Mohapatra for corruption?

Surely IT can write to the CJ of the HC or even the SC of the misconduct and ask permission to summon/examine the Judge if he does not cooperate. As a routine, they can open his IT return for scrutiny and send a notice to him ,if necessary with a request to the CJ for assistance in the event the concerned Judge refuses to comply with the scrutiny proceedings. Where is the fear or favour? The ITO is a faceless person so also the Judge.

May you substantiate with some evidence where the HC / SC judge have been summon by IT / Salestax / Excise Officials then we will upload the same