How Justdial cheats

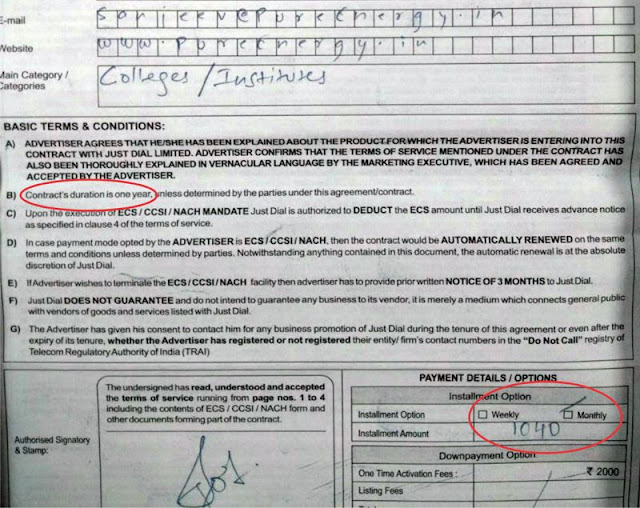

Pure Energy Academy’s contract with Justdial was for payment of Rs 1040/- per month, for a period of one year. See the terms of contract below.

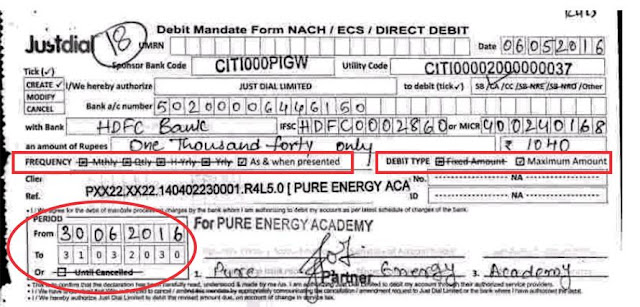

Two cheques were issued towards the first two monthly payments. However, Justdial activated the contract a day after depositing both the cheques on 3rd June. The delay of one month in depositing the first cheque appears to be because the signature, stamp and other details of the cheques contained were being used by Justdial’s backroom boys to creat a forged ECS/NACH mandate form enabling them to charge upto Rs 1040/- as many times in a month as they wished. With this phony mandate, Justdial could directly withdraw limitless money from Pure Energy’s bank account by presenting the ECS/NACH mandate for the next 14 years! Also, the ECS mandate was made out to be non-cancellable! See the forged ECS/NACH mandate below.

(Note: take a close look at this document; it is so obviously fishy! All the options are pre-tick-marked and cancelled in the printed form itself. They are not tickmarked or cancelled by hand, the form is printed that way! Even the supposed termination date of the contract – 31/03./2030 – is printed, and only the starting date is entered by hand. The frequency options i.e. Monthly, quarterly, half-yearly and yearly, are all pre-cancelled in the printed form, and “As and when presented” is pre-tickmarked. The debit type option of “Maximum amount” is also pre-selected in the printed stationery. Also notice that something has been pasted on top of the form, partly covering the words “Client” and “Reference” on the left-hand-side. Like a cheque, the ECS mandate is a negotiable instrument, so how can it have a pasted-on layer? Aren’t negotiable instruments rejected by banks if there is pasting, over-writing etc.? This ECS mandate defies commonsense!)

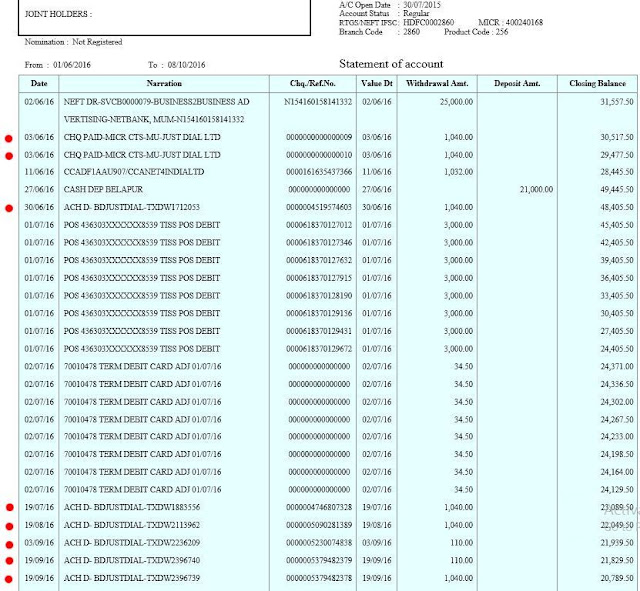

Using this dubious ECS mandate, Justdial started guzzling money from Pure Energy Academy’s bank account. Justdial encashed both the cheques on 3rd June, and debited Rs 1040/- on 30th June by ECS – three debits in the first month of the contract. Despite Sanjeev telling them to terminate the contract, Justdial debited Rs 1040/- in July, August and September, plus Rs 110/- twice in September. Within four months, Justdial took payment for more than six months.

See Statement of Account below.

Pure Energy Academy’s stop-payment instructions over net-banking and email, starting 31st August, were ignored, sidestepped and buck-passed by HDFC Bank. The bank stopped the ECS mandate only on 10th October. The bank’s actions of commission and omission need a closer scrutiny.

How HDFC Bank turned a blind eye

1) HDFC Bank did not seek its customer’s confirmation of this ECS mandate. Although the ECS mandate presented by Justdial defies logic (allowing unlimited withdrawals for 14 years) Defying RBI’s clear directions, HDFC Bank never sought Sanjeev’s confirmation of the ECS mandate. Had this basic step been taken, many clear signs of forgery and contradictions between Justdial’s contract and the ECS mandate would have come to light.

2) HDFC Bank did not send him SMS alerts when money was debited by Justdial. So Sanjeev did not notice this unusual activity until 31st August, 2016, when he got his accounts statement. Then he raised an alarm, wirinting to both Justdial and HDFC Bank executives. Both responded with delaying tactics, vagueness and buck-passing.

3) HDFC Bank managers are inadequately trained, ill-informed and non-committal. The bank managers clearly did not know where the original instrument i.e. ECS/NACH mandate, was to be found. The Belapur Banch Manager and others kept giving false promises, saying that they had initiated the process of getting the original ECS mandate, and it would land on their table within a few days. They contradicted themselves and each other repeatedly in this and other ways. Finally, on 15th October, they washed their hands off the whole problem, arguing that since NPCI had the original copy of the mandate, they were not authorized to access it. What the HDFC Bank managers advised Sanjeev was, “Let the police register an FIR against Justdial, then they will requisition the original copy of the ECS mandate from NPCI and scrutinize it as part of their investigations. We are no longer involved in your problem.” However, they said this orally and refused to put it down in writing.

HDFC Bank refuses to compensate Pure Energy Academy by reversing the debits. After belatedly examining the copy of the ECS mandate on 3rd October, it became clear to the branch manager and others that this was a case of fraud and forgery, but they refused to take any action. Their final stand is that Sanjeev must file a police complaint. If and only if the police register an FIR against Justdial, HDFC Bank will consider reversing the debits. This also is only a feeble oral statement, and the bank’s managers are unwilling to even talk about it with any certainty.

But what if the police does not register FIR? Suppose the police takes the stand that this is a banking issue, and therefore, they have no understanding of it, and therefore, Sanjeev should complain to appropriate authorities in the banking domain? Then Sanjeev will effectively be left with no remedies, and Justdial will get away scotfree! For HDFC Bank, however, it will just be business-as-usual.

ISSUED IN PUBLIC INTEREST BY Krishnaraj Rao 9821488114 krish.kkphoto@gmail.com

All the complaints regarding the fraud of JustDial can be registered at indianpeoplesforce.org. Your complaint would be taken up in front of relevant authorities.

FWIW, given that Bachchan is (1) an investor/sharedholder in JustDial, (2) a brand ambassador for JustDial, this is hardly surprising.

The banks are paid for regular debits by ecs/dd etc; hence see that as income and not their prime promise of safeguarding customer interests as per their claim to subscribe to ‘The Banking code’ (download from bank website of from banking code org site as common to all banks).

Read ‘The Banking code’ and advise/ quote it to Hdfc a known cheat bank on its promises. Customer must write to bank grievance, then Nodal and then approach Consumer forum (not advisable to approach Ombudsman as usually setup and paid by banks).

Also advertise widely and send with links to bank Nodal to act fast, usually they do.

Police may or may not take it up but he could try if he has any helpful contacts. Alternatively after going thru CF process he can file private criminal case. Police will take it up if presented as pure fraud and cheating which is Non cognizable, else don’t have to.

These kind of frauds are so common these days. Justdial is a small online company but even big companies do it openly. Basically, if they find a loophole to scam people they’ll use it without any guilt or shame. I’ve faced two such scams, but luckily I got my money back in both.

First was a pretty common scam done by almost all telecom companies. I faced it with BSNL and my father faced it with TATA Indicom so I’m sure about these two. The scam goes like this: they monitor phone usage and if they feel that it belongs to a rural or illiterate person, they start activating value added services without the user’s permission. Legally they can’t do this but if they feel that the user won’t understand what’s happening, they take the chance. I’ve also heard of our maid who said every time she recharged, the money was debited for caller tunes and she didn’t know how to deactivate it.

The same thing happened to me and BSNL started activating these services for my phone. I called customer care and deactivated the services but he refused to return the money and didn’t know how it got activated. Then I searched BSNL’s website, horribly designed that it is, and found their rules and guidelines. They have a user grievance redressal process but it was too long. Instead I found the email of some high placed officer in my state and emailed him a long mail telling him how BSNL was committing fraud and how they should be ashamed of themselves. I didn’t even threaten legal action. I just said that I was going to change my sim and just wanted him to be ashamed of himself. I got a quick reply that basically said sorry but didn’t accept it as a fraud. They said it was a mistake and in the coming days they recharged my phone several times and returned more than I had lost.

The second fraud was when 20 thousand rupees were deducted from my ICICI account in 4 transactions. ICICI did warn me through a phone call and asked if I wanted to block the card there and then and I did that. They suggested I file an FIR. I asked them if they would return the money and the customer care person wouldn’t answer directly but I understood that they didn’t have any legal responsibility to return the money. I searched online and found that the bank can’t return the money. Filing and FIR and complaining to the cyber crime cell also doesn’t lead to returning of the money. But if you find out the websites where the money was deducted, you could tell them that it was fraud and you’d have to submit the FIR and bank’s letter to confirm that it was a fraud and then the websites return the money if it hasn’t cleared yet so you have to do it quickly.

I found some code for the website names in my online transactions list. I googled it and found that all four transactions were done on two dating sites. One was seniordating.com and the other I don’t remember now but it was some dating site only. I emailed both of them. Both had two transactions each. I told them that I could provide FIR and other confirmation. They didn’t respond but returned my money directly. In the end I lost around 1k because the money was converted twice from rupees to dollar and back. But I got 19k back. I was happy but didn’t understand what had happened.

Doing some more research I feel that this is a scam done by these dating sites. They acquire credentials from hackers and do online transactions till the card is blocked. Most people don’t know what to do when this happens. Most people keep fighting with the bank and the bank uses delay tactics. Till then it’s too late because the money has already transferred to the site’s account. Those who do contact the website, they return the money instead of getting into a legal hassle. So if they attack 10 accounts, and 1 complains they return his money and keep the money from the rest 9 accounts.

It’s a shame that such scams exist all over. I feel the SMS charges deducted by the banks is also a scam. I don’t need to know every month what my bank account is. But I don’t stop the service as it does come in handy during other scams. Basically, people have no morals anymore. Whatever you can get away with, is okay. From the smallest website to the office of the president of the US, everyone’s corrupted and only cares about money. It’s so depressing.