Osmanabad district in the Marathwada region of Maharashtra has been experiencing drought for several successive years leading to crop failures and increasing problems with bad loans and farmer suicides. As per government records, over a thousand farmers from here have committed suicide. The actual numbers are bound to be higher, as the government records often don’t record those who either took loans from unregistered money-lenders, do not have their own land, or did not leave behind a suicide note (many are illiterate). The problem of farmer suicides had reached such horrifying extents that banks had been urged caution in the recovery of loans that were not paid.

This year some late seasonal rain had brought hope. After many years, it seemed like the cycle of despair was about to break and farmers were looking forward to sowing winter crops, when a new crisis hit. Demonetisation. Banks in rural Maharashtra have seen very little by way of new notes coming in to replace the Rs. 500 and Rs. 1000 notes that have been withdrawn as legal tender. As a consequence, there is a severe cash crunch in most villages. Indeed in most of rural India. With Rabi crops due to be sowed and no money in hand to buy seed, things looked hopeless. The government allowed the purchase of seeds with old Rs. 500 notes, allowing a tentative hope to seed, when a further crisis hit several homes in Nagur village.

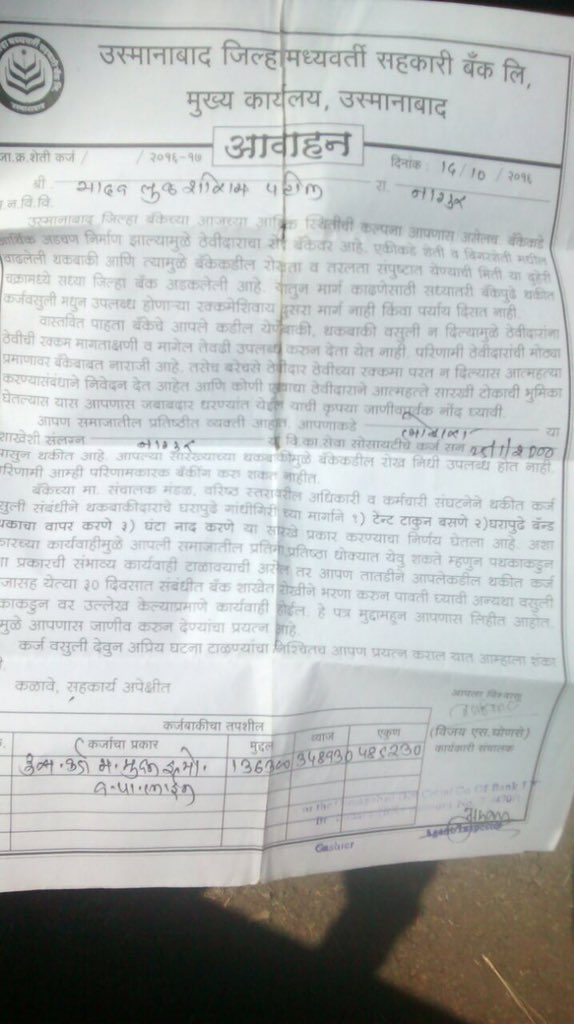

The Osmanabad District Cooperative Bank Ltd, has started sending notices to farmers with outstanding loans asking them to repay the loans or the bank would take socially humiliating measures against them. So far over 30 farmers in Nagur alone have received these notices; in the Lohara taluka, over 1000 farmers. The notices are dated 14th October 2016, however the farmers claim that they received them on the 23rd November 2016 (the notices are likely backdated, essentially rendering the one month notice meaningless). The farmers have been informed that unless the loans are repaid, they will begin to face recovery process in December.

This is a translation of the letter (written in Marathi):

Osmanabad District Cooperative Bank Ltd., Head Office, Osmanabad

Agriculture Credit / / 2016-17. NOTICE. Date: 14/10/2016

Shri. Yadav Lukshiram Patil , Place: Nagur

Greetings.

You must be aware of the economic situation of the Osmanabad District Bank. Since the bank is in a financial difficulties, the bank depositors have their full focus on the bank. Due to the increase in overdue unpaid loans there is the fear of loss of liquidity for the bank which is now caught in this quagmire. At least at this time, the only option the bank has to improve its situation is to recover the overdue loans. Naturally, due to the pending loans with you, the bank is unable to pay its depositors the amounts they want to withdraw whenever they want to withdraw. As a result, the depositors are very disappointed with the bank operations. Similarly, many depositors, when they are faced with the prospect of being unable to withdraw their own money from their accounts are sending us statements that if they cannot withdraw their money, they will be forced to commit suicide and you should be aware that if any depositors commit suicide for such reasons, you will he held responsible and you should understand this.

You are a respectable member of the society and you have an overdue loan since 25/1/2000 with the Y. V. K. Seva Society which is a partner of ‘Bhorala’ (not sure of this name). Because of your overdue loan, the bank is facing a cash crunch and the bank cannot conduct its operations effectively.

The bank’s management committee, senior officers and employee association have decided to use Gandhigiri to try and recover the loans. For this, the bank has decided to do one of the following: 1) Put up a tent opposite your house to protest 2) Make use of a band 3) Ring bells

Due to these actions, your standing and image in society is likely to be in danger. Therefore, to avoid such a situation, you should immediately repay your overdue loans with interest in the concerned bank within 30 days and take a receipt for such payment. Else, the recovery team will take action as explained above.

We are deliberately writing this to you so that you are aware of the situation.

We are in no doubt that you will repay your loan and avoid any unpleasant events from happening.

Expecting your cooperation,

Details of Overdue Loans:

Type of loan, Principal: 136300 Interest: 348930 . Total : 485230

Yours faithfully,

Sd-

Vijay S. Ghonse

Executive Director

Suresh Ediga, an NRI who had done volunteer work related with organic farming in the region over the last few years was informed about these notices when Dnyaneshwar, who runs an NGO to improve farmers’ financial literacy, told him about the plight of the farmers receiving the notices. The farmers are understandably anxious. Cash strapped, demonetisation trapped, and due to sow their rabbi crops, they are in no condition to repay the loans, which have piled up over years of severe drought, with dues that have doubled or tripled in the interim in many cases. One season of rain is nowhere close to adequate to clear loans. The bank is pressuring them because the bank itself is short of cash and this year, due to the rain, the restrictions on loan recovery have been relaxed. Earlier when the bank had threatened farmers about loan recovery during drought, the district collector had intervened. It is unclear what will happen now. Suresh has contacted the district collector again, who has assured him that he will intervene to ensure no harassment happens, but it appears to be a far-from-resolved situation.

The bank itself is close to bankruptcy. Dnyaneshwar contends that far larger loans taken by politicians, sugar factories and other local bigwigs were written off routinely, while farmers are pressurized to repay their own loans. An interesting practice is that moneylenders take loans from the banks and loan this money to farmers. These loan defaulters are politically powerful and well connected and the farmers are not able to confront these practices for fear of backlash. The bank is aware of these practices and yet easily extends loans to them, but the loans to ordinary farmers are very difficult to get and the interest is calculated in a manner that the farmers cannot understand, departing from RBI guidelines where the amount of interest should not exceed the capital. Farmers have often been advised to restructure but they have not been provided adequate information and bank officials, from time to time have taken their signatures on various papers, but no restructuring appears to have taken place. In several cases, the interest is several times the capital. With demonetisation no one has any money at all, and the bank seems to have seen this as an opportunity to extort whatever cash they can get their hands on, from farmers.

All the farmers receiving these notices are planning to meet collectively to decide a course of action. With their backs to the wall and at risk of suicide, they are being threatened that they will be held responsible for potential suicides of those who will not be able to withdraw money from the bank due to their non-repayment of dues. They fear harassment from the recovery agents of banks. Being financially vulnerable themselves in a region where there are several suicides of farmers per week, the threat of being held legally, socially or morally responsible for the suicide of any another person, even in an illogical manner, is a particularly traumatizing threat. The idea that they could publicly be accused of causing suicides and humiliated has them all in a terrible state and Dnyaneshwar fears that this kind of extortion can lead to increased suicides this year. It is a Mexican standoff made worse by the cash crunch stemming from demonetisation. The farmers inform Suresh that they have been warned of actions taken to socially humiliate them beginning in December unless they pay off their dues.

Unless something is done to defuse the situation, the farmers could be faced with harassment over loans they don’t have the money to pay off in addition to the stress of not having legal tender for expenses related to winter sowing (they can only buy seeds with the old notes). Banks need to find cash to satisfy increasingly irate customers bombarded with information about the withdrawals they are entitled to make, yet almost never see in rural India. People need money to survive, and banks are where they have been told they can get the money. It is a tinderbox of desperation waiting for a spark.

What happens next is anyone’s guess.

Update: This story has been taken action on. It is now getting the attention of various people from banking to government and media. More information will definitely follow. There are actions being taken to protect the farmers from further threat.

It is a fact that after decades of sham democracy / military dictatorship, hellistan continues to be a highly feudal society with 90% of wealth of hellistan controlled by 7 families [eg bhutto, shutto, sharif and not so sharif blah blah]

In India, we still have pockets with similar system where a few still lord over many – eg Maharashtra, Karnataka and Andhra. And the system has been nortured and imposed mostly by feudal land lords who became powerful under decades of Congress rule of the country and these states.

Lots of vested interests are trying every way to pull Narendra Modi down, who may be the only hope of have nots all over India [ do not believe in fake bleeding hearts who do not have any compassion for anyone except for themselves and their family ]

Yes and Hitler was the only hope for Jews.

Necessary to get more coverage of rural economy