October, 2016: Imagine you are having a gynaec examination. With his rubber-gloved fingers inside you, the gynaec starts a casual chat about why you should buy his home-grown brand of condoms and intimate products. Creepy? Yeah, well, but that’s how HDFC Bank and other private-sector banks work. Actually, HDFC Bank is like if your gynaec collects real-time information about when and with whom you have sex, what kind of sex you are habituated to, exactly when you menstruate, what kind of lingerie and sanitary pads you are currently wearing, etc. and then this gynaec goes and hires a bunch of MBAs and college freshers, calls them “Relationship Managers”, lets them hang around his clinic pretending to be gynaecologists themselves till you start feeling comfortable enough to tell them about your intimate problems.

Then your gynaec goes and gives these relationship managers access to your information on their computer screens, with monthly targets for selling you condoms, sanitary pads and other intimate products. They call you and make you feel important by calling you a preferred customer, and giving you a platinum card. So, if your periods are four weeks late, you get a call that goes like: “Good morning, ma’am, I am Nikhil, your personal banker. May I interest you in visiting our abortion clinic? Oh, you don’t want to abort? My apologies, madam. May I take this opportunity to gift you an early booking in a maternity home with whom we have a tie-up? We also have a tie-up with Amazon for incredible discounts on maternity gowns and chocolate-flavoured condoms this Diwali. When can I come and meet you to book your orders?”

Bankers are routinely privy to salary details, annual income, etc. that it is their business to know. However, the salesmen and women who hang around your bank have no business to know your financial details. HDFC Bank branches have a bunch of glib young men and women who are very approachable and go out of their way to fill up account-opening forms, etc. for you. Just because they sit inside the bank, you think they are “bankers” and you never hesitate to ask them to access your account on their computers. So these sales people get to know private things such as a huge cash-flow into your accounts when your life insurance policy matures, or you take VRS, or sell your house, or book profits in the share market.

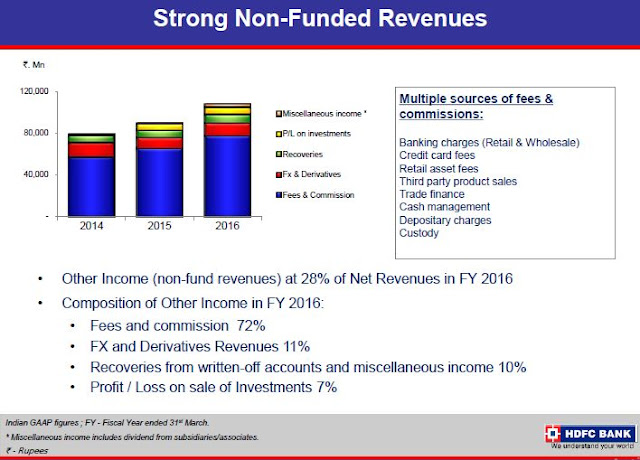

If you are flush with funds, your “personal banker” says, “Sir, can I interest you in our tax planning products to reduce your income-tax and capital-gains tax liability?” Alternatively, if you are struggling to pay credit-card bills, frequently overdrawing your current-account, breaking fixed deposits prematurely, etc., your relationship manager nudges you to take a personal loan or gold loan which he knows you are unlikely to repay in time. Loan disbursal lets him meet his monthly targets and earn commissions, and when you default on repayments, heavy penalties and foreclosure of your gold loan helps the bank reap handsome profits. Predatory lenders used to be called loan sharks and pawn-brokers! How the times have changed!

|

| Customers are set up for systematic long-term exploitation by HDFC’s bankers and non-bankers acting in concert. |

Here’s a real-life anecdote: An elderly couple walked into an SBI Bank branch to fill up their 15H form, so that TDS would not be deducted on their interest income. A friendly-looking lady sat them down at her desk, filled up their forms for them, and persuaded them to invest Rs 3 lakhs in SBI Mutual within 15 minutes. The only reason that the elderly folks trusted this woman is that they thought she was a full-time bank staffer, whereas she was actually a freelance sales agent! .

Another anecdote: ICICI Bank organized free Aadhar Card camps in the foyers of a residential building in a posh Borivali neighbourhood. While one solitary minion sat in in the foyer taking fingerprints, mugshots, etc., half-a-dozen bank officials hung around persuading the waiting people to open accounts with ICICI Bank, and visited their homes on various pretexts. And they were pushy – it was very difficult to say no to them! Why are banks so keen on opening lots of accounts? Because it “provides customer base for ongoing cross-sell through branches”. In other words, every account holder is a potential customer for credit cards, loans, etc.

|

| Emails giving you updates about your HDFC account balance are ethically OK… but these are the narrow end of the wedge. |

|

| Emails selling you the bank’s debit card services seem ethically OK, but only because banking and debit/credit card businesses are so inextricably mixed up. |

Bottomline: In their mad race for year-on-year growth, retail bankers are crossing over some boundaries of the client-banker relationship. HDFC Bank is abundant in examples of this unwholesome trend.

These may not necessarily be adequate grounds for filing complaints to RBI or the banking ombudsman, or for going to consumer court. But this distasteful behaviour shows a tendency to exploit the customers’ ignorance, dependency and blind trust in their banks.

Krishnaraj Rao

9821588114

krish.kkphoto@gmail.com

POSTED IN PUBLIC INTEREST BY

Suliman Bhimani

9323642081

sulaimanbhimani11@gmail.com

Very right rather than giving basic banking services these R M are more interested in selling mutual funds & Insurance products, when you don’t give them business they start ignoring you, in the pretext of helping the preferred customers they really are selling agents of the banks

So very true

And not only Private Sector Banks.

Some of the Public Sector Banks are trying to reduce NPA exposure through squeezing out money from other customers at the slightest pretext.

One glaring example is PNB, which has blocked lakhs of accounts in last few months on pretext of non-KYC. The customers do not even know that their account is blocked, and soon, all the funds would be captured by PNB

shameful behaviour indeed.. but your right..

not much one can do about it..

for now.