DeMonetisation did not promote the uptake of digital transactions

Driving India towards a less-cash, digital payments economy was one of the aims claimed by the Prime Minister when he invalidated 86% of India’s circulating currency. The reasoning was that India was a largely cash-based economy; if circulating cash was reduced, people would rapidly move towards electronic, or digital payment systems for their commercial transactions. That at any rate was the hope.

Did it happen?

Rupa Subramanya thinks it did. She claimed as much in a blog in the Hindustan Times. She accepts that the original aim of taking out black money has not been met, given that almost all of the Specified Bank Notes (SBNs) hav now been returned for exchange or deposit. But she goes on to say that her research shows that the secondary aim of pushing the country towards digital payments and away from a cash based economy has been achieved. To quote from her article:

….several key components of digital payments such as Point of Sale Debit and Credit (PoS) purchases, National Electronic Fund Transfer (NEFT), Immediate Payment Systems (IMPS) and mobile banking, are way above their pre-demonetisation trends

…..

The bottom line of the research conclusively demonstrates that there was a structural break after November 2016 with a permanent increase in digital payments and decrease in the relative importance of cash. Whatever you may think of the original goals and whether they succeeded, it’s clear digitisation is one demonstrable success story of demonetisation.

She expresses the use of digital payments not in absolute terms but as a proportion of total M3 Money. However, though she says she has published her findings, they are not in peer reviewed journals. Rather the findings are published in research papers for the Observer Research Foundation – a think tank. I haven’t seen these papers and therefore cannot comment on the methodology of the research. In any case she does not cite a source, nor does her article present the full results of her analysis. Her data source, though is the same that I have used earlier in a series of tweets and in a twitter Moment. This is the Reserve Bank of India’s Database on Indian Economy.

I believe her conclusions are premature, they may even be misleading or wrong, based as they are not on absolute value of payments but on payment volumes as a ratio of M3.

I present here my own much simpler and more intuitive analysis of the RBI data set and draw very different conclusions.

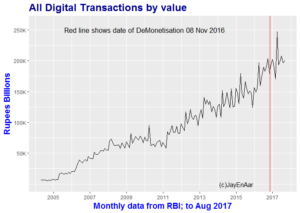

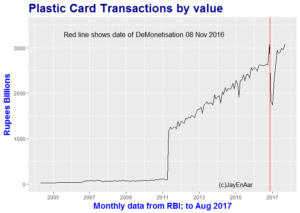

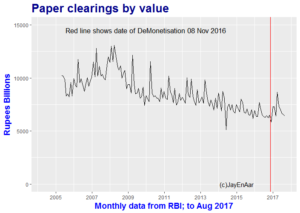

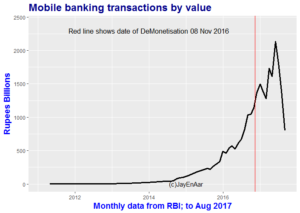

Data and Methods: The RBI dataset consists of monthly transaction amounts for each of several different modes of digital transactions. The data goes back to 2004 and the latest available data is for August 2017, 10 months after DeMonetisation. Rather than look at just at the figures a few months either side of D-Day (DeMonetisation-Day if you are a fan or Disaster-day if you are a critic), I suggest it is best to look at the entire period. Since these are time series data (defined as data collected consistently with a defined periodicity – in this case monthly) the most obvious and simple technique would be to chart the data against time, draw a vertical line at D-day and look for a change in the trend . If D-Day did indeed result in qualitative sustained change in aggregate behaviour the change in trend would be obvious. I used the statistical programming language, R and the charting package ggplot2 to draw and annotate the charts. These statistical programmes are widely used in academia and business.

Results: The results of my analysis are best presented as a series of charts. They speak for themselves.

The key point to get is that by looking at the entire time series for each of the main digital payment modalities, two conclusions leap out immediately.

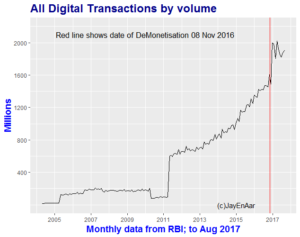

One, that in the first few months after D-Day there was a spurt the volume of payments made by digital means.

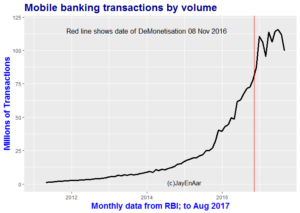

Two, for some payment modalities, they have subsequently fallen back to levels that were seen well before D-day. In particular retail electronic clearing, and plastic card volumes are effectively back on the same trend growth they always were since long before D-Day. Mobile banking transactions in particular were going up steeply in the months before D-Day was even a glint in anyone’s eye; they went up even more steeply after D-day – and here’s the crucial point, they have more latterly dropped right back. If we superimpose what we know about the re-introduction of new currency notes this looks like a perfect fit. As cash was re-introduced into the system, people began giving up on mobile banking transactions.

Another set of charts looks at the volumes (i.e number) of transactions.

Here there appears to be a small shift upward that, despite some month on month fluctuation appears to be settling down at a level clearly higher than anything seen pre D-Day. In the case of mobile transactions it is small-ish numbers and starting from a very low base; in the case of digital transactions its a step change from about 1.4 billion transactions a month to about 2 billion. But the volumes transacted appear not to have shifted much at all – it is in keeping with long-running trend and it is certainly not a step change.

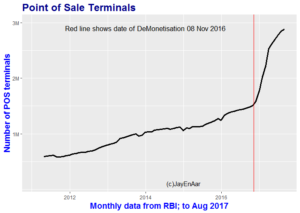

Undoubtedly, there has been a steep growth in the number of Point of Sale outlets, as shown here:

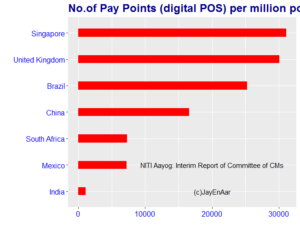

Starting from a very low base, this is only to be expected given the huge Government push including cash incentives and subsidies for the take up of POS machines. The extend to which these have penetrated much beyond the largest urban centres and the plushest retail outlets is the big question. The last chart above is based on data published by NITIAayog

Conclusions. My analysis leads me to conclude that any effect of DeMonetisation on the use of digital payment systems has been transient, small and short-lived. Some change has occurred (POS terminals for example) but the fact that both retail electronic clearing and card usage is back on what I call ‘trend growth’ (i.e. on the same trend as obtained before D-day) would suggest that there has not been a structural change that can be confidently ascribed to DeMonetisation.

Post-script discussion. In all the commentary on Digital Payments insufficient attention has been paid to a most fascinating report that was published on Oct 5 by Visa India. Amitabh Kant, CEO of NITIaayog, wrote the foreword to this report. Nobody who read the detailed figures or had taken in the measured recommendations in this report would have supported a sudden, cataclysmic and disruptive withdrawal of 86% of the currency, certainly not with the intention of promoting a digital payments economy. Among the key findings of the report are:

- Cash usage costs the economy 1.7% of GDP (Note: borne largely by the State)

- According to a 2014 World Bank survey, only 0.38 percent of women above 15 years old used the internet to make payments compared with 2.04 percent

of men; 3.25 percent women had used a debit card versus 5.25 percent of men. - The cost of a point-of-sale (POS) terminal in India ranges from INR 8,000 to INR 12,000. The annual operating cost is INR 3,000

per terminal. Low transaction volumes especially outside of Tier 1 cities, make it unviable for banks to expand their footprint into such segments. - RBI and the Govt of India already had a plan to transition to a less-cash economy.

- If India invested a total of INR 58,000 crores (USD 8.6 billion) over the next five years through tax

rebates, it could not only expedite the pace of payment digitisation but also save about INR 70,000 crores (USD 10.4

billion) in that period through a reduction in the cost of cash with a potential to save 4.7 lakh crores (USD 70 billion) - If we invested 60,000 crores and undertook a series of reforms and regulatory changes cash use could come down in 2025 from 1.7% of GDP to 1.3%.

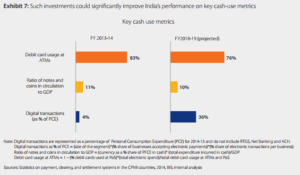

- In particlar see exhibit 7 of the rport which details the benefits from a sustained programe of policy changes as well as investments to improve the infrastructure for digital transactions. Effectively, a 5 year programme of sustained policy implementation and investment would potentially result in a growth of digital payments for Personal Consumption Expenditure from 4% to a whopping 36%, a drop in cash need from 11% of GDP to 10%.

Nice article, but I don’t think the effect of DeMonetisation on the use of digital payment was short.