Extortion of inflated loans from farmers during #demonetisation

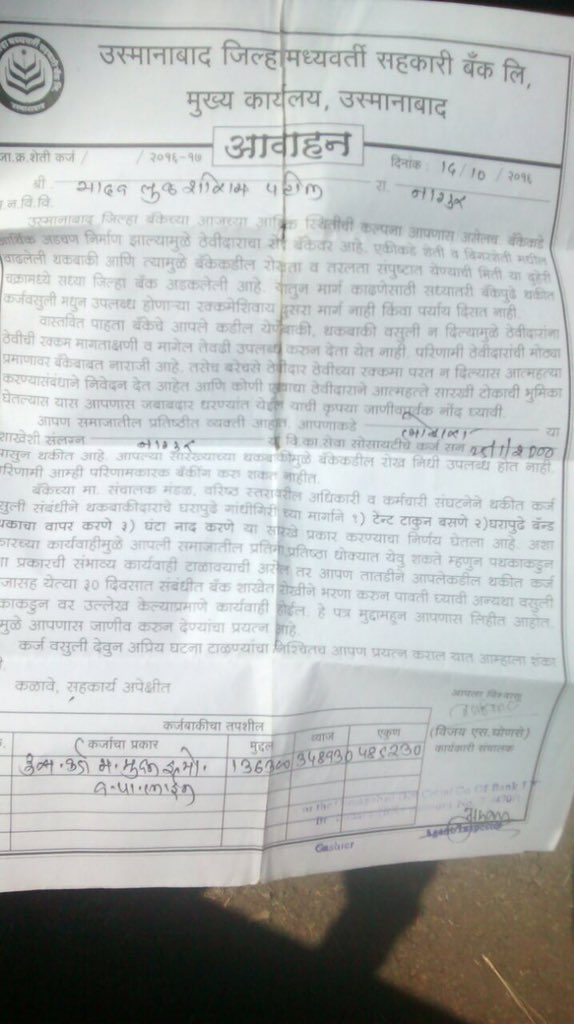

The Osmanabad District Cooperative Bank Ltd, has started sending notices to farmers with outstanding loans asking them to repay the loans or the bank would take socially humiliating measures against them. So far over 30 farmers in Nagur alone have received these notices; in the Lohara taluka, over 1000 farmers. The notices are dated 14th October 2016, however the farmers claim that they received them on the 23rd November 2016 (the notices are likely backdated, essentially rendering the one month notice meaningless). The farmers have been informed that unless the loans are repaid, they will begin to face recovery process in December.

Extortion of inflated loans from farmers during #demonetisation Read More »