How does linking your Aadhaar to your bank account destroy the banking system?

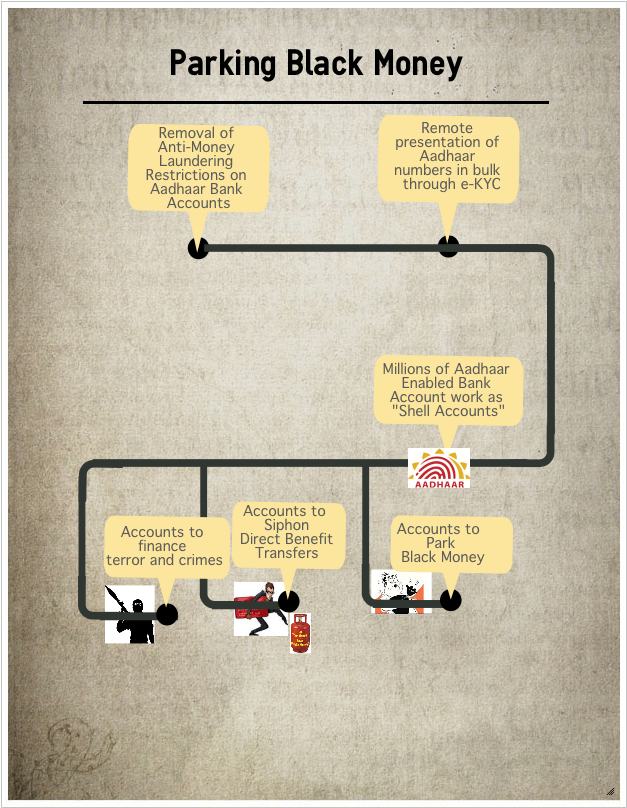

Linking Aadhaar to bank accounts is a recipe for creating benami[2] bank accounts and scaling benami bank transactions. It threatens to destroy your bank accounts and destroy the country’s banking system. It’s devastating that the integrity of banking processes is being destroyed by dividing, outsourcing and privatising processes integral to core banking so that they become the responsibility of no one.

How does linking your Aadhaar to your bank account destroy the banking system? Read More »